Measuring and Optimising Brand Awareness Campaigns with Attention Metrics

We’re all tired of measuring brand awareness campaigns with bogus metrics like CPM and Reach. Could “Attention Metrics” be the solution? We break down how they work.

Measuring the ROI of brand awareness campaigns can be challenging, especially for digital campaigns that drive offline conversions or purchases on external retailers. Brand lift studies and econometrics are great options post-campaign, but what metrics can we use to optimise brand campaigns mid-flight?

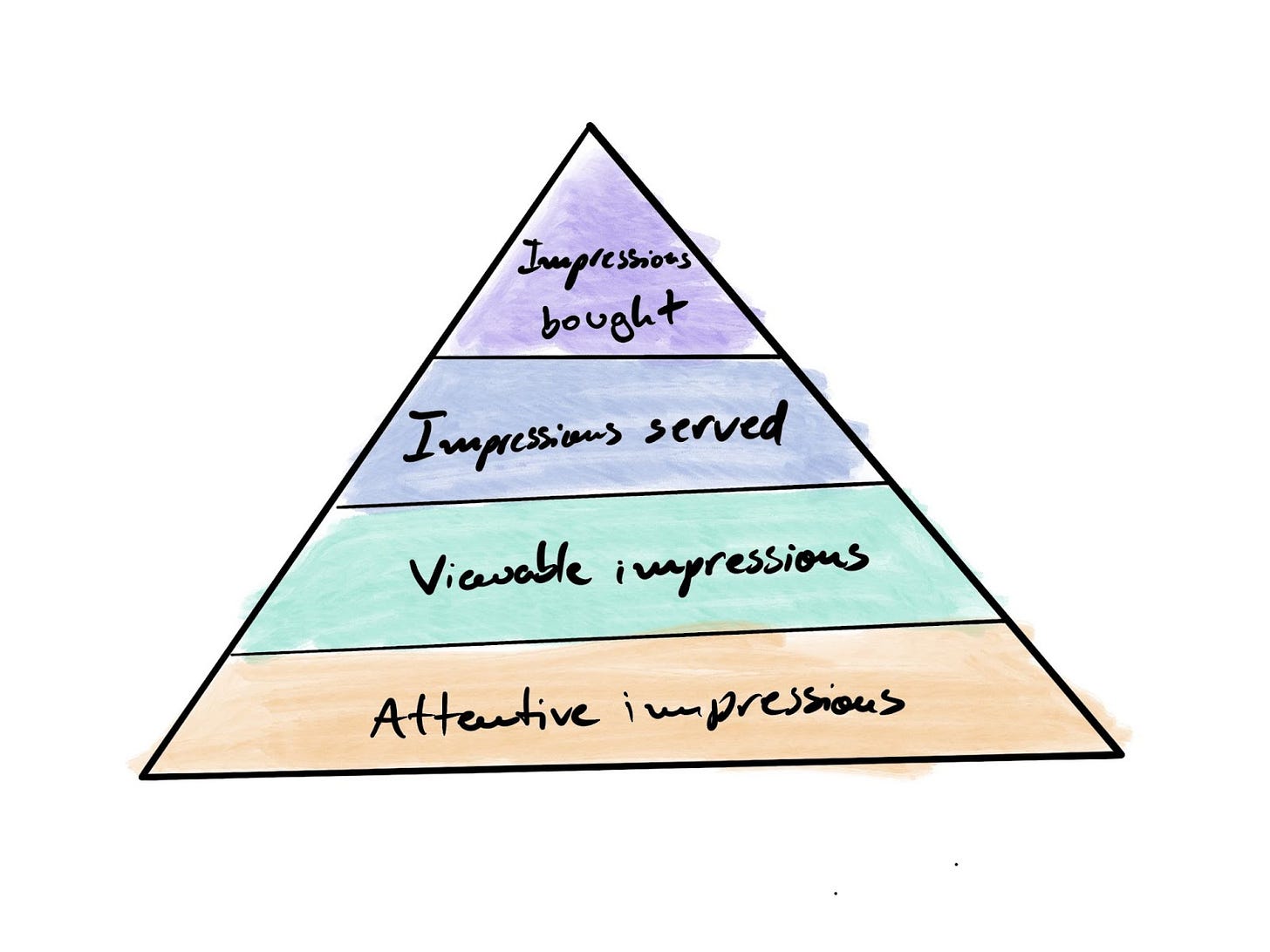

Traditionally, we use impressions (e.g. CPM) and unique visitors (Reach). But that can be inaccurate or incomplete, leaving marketers in the dark about the effectiveness of their campaigns. Knowing you’ve reached an X number of people is very different from knowing if you’ve reached the right people.

Enter ✨attention metrics, a new way of measurement that aims to predict the likelihood of an audience engaging with ads.

Late last year, I helped a FMCG client research and test attention metrics. In this article, I will explore how attention metrics work, including how they are used for both measurement and media buying.

How attention metrics are measured

Attention metrics providers use multiple data points—such as time in view, dwell time, scroll depth, and click-through rate—to measure how “attentive” an ad is.

However, the most important data point for attention providers is eye-tracking technology.

Eye tracking is a technique that uses cameras and software to record and analyse where people are looking on a screen. With facial coding, they can also input people’s facial expressions.

Providers run eye-tracking studies showing “test participants” multiple creatives on different ad placements on publishers’ sites. The data they capture from these studies allows them to rate the “attention” received by each ad placement on each ad publisher.

For example, given our way of reading in the Western world, ad placements on the top left of pages usually receive more attention than average.

Placements, not ads, are measured

At its core, Attention Metrics tell you what is the predicted attention level of the ad placements you’ve bought. This can then be used to optimise your buying towards the highest value placements.

However, it cannot inform you how attentive your actual creative or ad was. Some providers offer ad-hoc creative studies for measuring the attention level of your ads with their eye-tracking technology. These can inform your creative team pre-launch to find the best performing ads, but this technology can’t be used mid-flight.

Reporting and Media Buying on Attention Metrics

Manual or automatic measurement

There are two ways to report on attention metrics:

Wrap your creatives with the provider’s attention tag

For Programmatic Advertising, providers offer an attention tag that can be wrapped on a creative similarly to an Ad Server or a Brand Safety tag. Whenever an impression is served, the tag sends data to the provider on the placement and, in some cases, captures additional data like hover time.

Armed with this data, providers can calculate the attention level of your purchased media. This data can then be delivered and incorporated into your dashboards all the way to reporting on “Cost per Attention Unit”.

This was the route we went with for the FMCG client.

Provide attention providers with access to granular placement reporting

Attention metrics measure the quality of an ad placement. By sharing data via a report that’s segmented per publisher, page and ad placement, providers can then predict what was the attention generated from your ads.

For walled gardens where you can’t wrap creatives, such as Meta, this is the only alternative of measuring attention today.

Using an attention algorithm for media buying

Some providers also offer buying algorithms for DSPs, like DV360.

In this case, data is sent directly from your DSP to the provider. This data informs the tool on what placements and publishers you’re bidding on. The provider will then apply a bid multiplier that can increase or decrease the bid depending on how they rate the level of attention of a certain placement.

For example, on the same publisher, you could send a higher bid for a top left placement than a bottom right placement.

Tools for Measuring Attention Metrics in Advertising Campaigns

I researched several attention providers during this project. And there’s more and more AdTech companies providing these types of metrics nowadays, including industry’s heavyweights like Double Verify:

It was difficult to assess the quality of their attention measurement of each provider. For the client I worked with, we chose to do a geofenced advertising test to calculate the correlation between attention measurement and revenue uplift.

Apart from the accuracy of attention measurement, some other considerations when picking an attention provider are:

Are you interested in both attention measurement and attention media buying? If yes, what is their fee structure like?

Does the provider support measurement of walled gardens?

Does the provider have enough data from publishers in my target market? (This is particularly important for locations with right-to-left reading, such as Asia and the Middle East.)

How does this partner integrate with your AdTech stack, including Ad Server and BI?

Implementing Attention Measurement in your Paid Media

Attention Metrics are a welcomed attempt to fix the major problem that is measuring and optimising brand campaigns.

While they can’t tell (by default) what’s your best performing and eye-catching creatives, they can assist advertisers in buying impressions on the most effective placements and publishers.

Testing attention metrics can be a bit of a handful. The only fruitful methodology that I’ve found was geofenced tests, paired either with revenue uplift of brand uplift studies. However, it’s crucial to quantify the accuracy of an attention provider to get the buy-in of your organisation.

Looking to get started with attention metrics?

If you’re in the search for the right Attention provider or wanting to get started with your first Attention test, I might be able to help! I’m a growth and marketing analytics consultant. Read more about my work on my website or email me!